China’s YMTC Rises in Consumer NAND Market, Driving Global Memory Industry Shakeup

China’s Yangtze Memory Technology Co., Ltd. (YMTC) is rapidly expanding its presence in the global NAND flash market, particularly in consumer segments such as smartphones and PCs. As YMTC’s share climbs toward 10%, the company’s growth is reshaping competitive dynamics and potentially triggering a new wave of industry restructuring among global memory manufacturers.

YMTC’s Market Expansion Accelerates

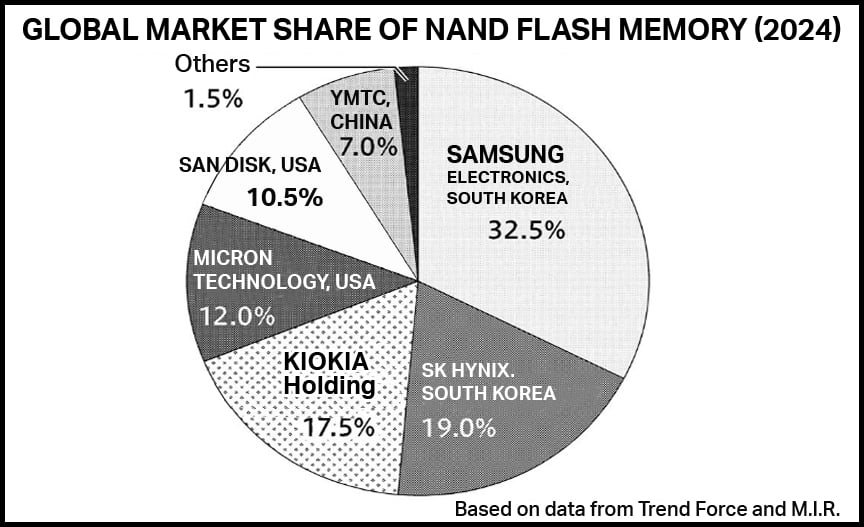

The NAND flash memory market is undergoing major shifts as YMTC gains ground in consumer applications, supported by the concentration of electronics manufacturing in China. According to research firms, YMTC’s global market share has already reached 7–10%, with sales in Q2 2025 estimated at 11.8 billion yuan (≈252 billion yen), according to M.I.R., a Nagoya-based research company specializing in Chinese manufacturing.

A source in the semiconductor industry noted, “If you open your computer, you’ll likely find YMTC’s NAND inside,” highlighting the company’s growing footprint, particularly in Chinese-made electronics.

Competitive Gap Narrowing with Global Players

Data from TrendForce indicates that U.S.-based SanDisk, ranked fifth globally, achieved $1.9 billion in NAND sales in Q2 2025—about 280 billion yen, representing a 12% market share. The sales gap between SanDisk and YMTC is now less than 30 billion yen, suggesting YMTC is closing in fast.

M.I.R. further predicts that YMTC’s market share could reach around 10% in 2025, solidifying its position among top-tier NAND suppliers.

Domestic Substitution and Competitive Pricing

YMTC’s growth is being fueled by China’s broader push to increase the use of domestically produced components, alongside major smartphone makers like Huawei turning to homegrown suppliers. Additionally, YMTC’s NAND chips are priced lower than those from Korean competitors, boosting its share in the Chinese consumer electronics market.

Global Players Shift Toward Data Center Business

In response, NAND manufacturers in Japan, the U.S., and South Korea—including Kioxia, Samsung Electronics, and SK Hynix—are redirecting their focus toward data center solutions such as enterprise SSDs.

Kioxia Holdings, Japan’s sole NAND producer, aims to lift its SSD market share to over 15% in the long term. Similarly, Samsung and SK Hynix are doubling down on enterprise SSDs and high-bandwidth memory (HBM) to support the growing AI infrastructure market.

Potential Industry Restructuring Ahead

The growing dominance of YMTC, coupled with the fragmented nature of the NAND sector, could intensify pressure for consolidation. Analysts suggest that YMTC’s expansion might revive discussions of a potential merger between Kioxia and SanDisk, two long-time collaborators and NAND specialists.

Source: Nikkan Kogyo Shimbun