Machine Industry Trends in 2020

Machinery is considered to be the starting point of metal technology to production in many industries including automotive, electrical and electronics, mold and die, machinery and tools, and other metal products. We shall look at the machine industry trends in 2020 since it reflects the direction of the related manufacturing sectors. The forecast numeric data and analyses from leading agencies and major players here cover the groups of machine tools, metal forming machines, and automation. The assessment shows that it is going in a fairly good direction and identifies potential markets. Read more in this news.

5G and Semiconductors: Major Customers for Machine Tools This Year

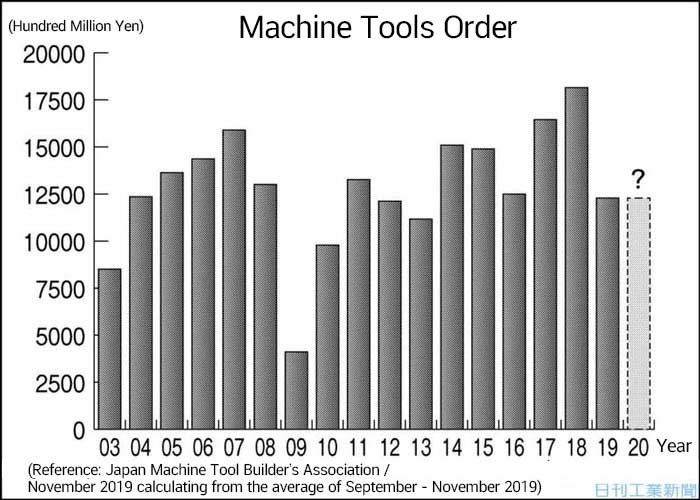

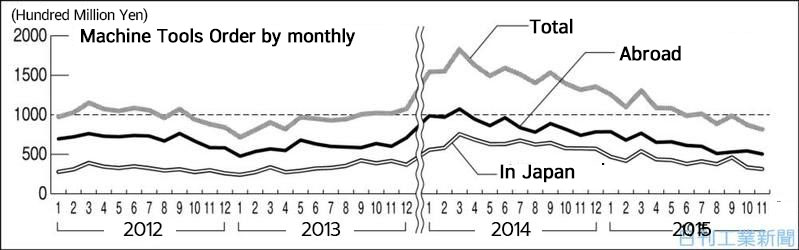

In 2020, the value of Japanese Machine Tools market is likely to be less than 1 trillion yen, which is considered to be lower than the standard of the machine tools industry or an average value of 100 billion yen or more per month, and contrary to the forecast data of the Japan Machine Tool Builder’s Association (JMTBA), 1.2 trillion yen.

The main reason for the decline in market value is due to the slowdown in the global automotive industry. However, it is difficult to get precise predictions for this year since it is the year that the manufacturing industry focuses on 5G technology. It is yet to be observed if the machinery related to producing the parts for 5G products will be able to push the total value higher.

However, many have predicted that this year's machine tools orders will start to recover in the second quarter and so has JMTBA predicted.

China and Europe Ready to Recover

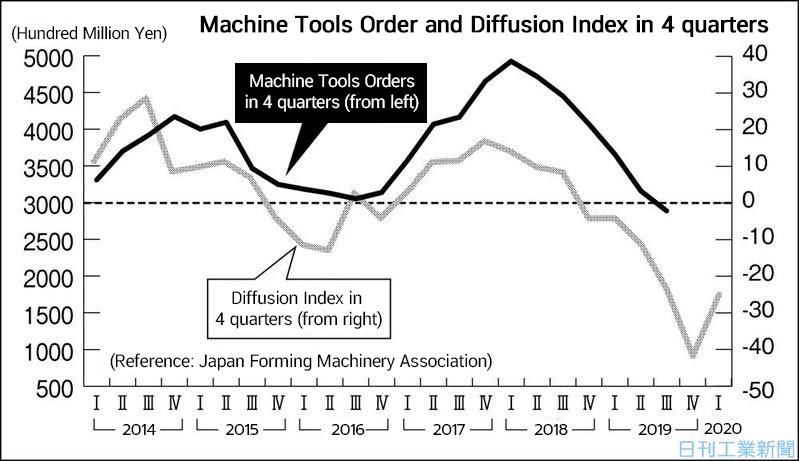

According to the survey of many machine tools manufacturers, many believe that the market will improve this year. In December 2019, JMTBA predicted that in the first quarter of 2020, the diffusion index would be -25.0, which is a 16.7% improvement from the previous survey.

In addition, the National Bureau of Statistics of China revealed that the Purchasing Manager Index (PMI) index for November 2019 stood at 50.2, or up 0.9 from the previous month, after a continuous decline of more than 7 months. Same happened to the PMI from the European manufacturing industry made by IHS Markit, which stood at 44.1, or an increase for the second consecutive month, even though it remained at the low threshold for the fifth consecutive month.

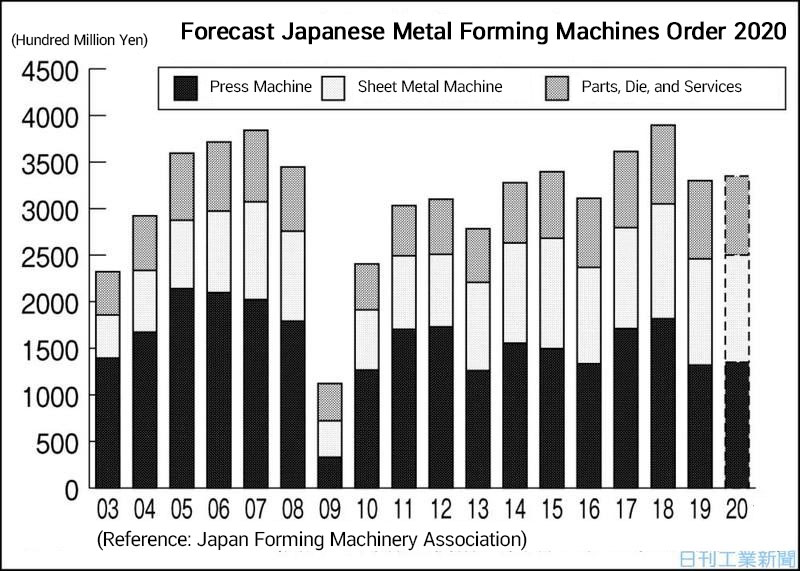

Great Potential for Metal Forming Machines in Japan and US

Japan Forming Machinery Association predicts that the orders for metal forming machines in 2020 will reach the eighth highest since the founding of the association. It is expected that there will be more investment in the middle of the year due to changes in the automotive industry and the direction of the trade war.

If categorized by machine type, it is found that the demand for press machines in Japan is at 135 billion yen or a 2.3% increase from the previous year, the demand for sheet metal machine is at 115 billion yen or a 0.9% increase, the demand for services is at 85 billion yen or a 1.2% increase, and the demand from abroad increases by 1.0%.

The Demand for Automation Is Promising

This year, the shortage of labor is another problem that will accelerate the demand for industrial robots and automation systems, especially in exports, as opposed to the slowdown in Japan. The US presidential election will beneficially affect the automation industry.