Electrical Companies Shift to Solar Panel Business, Emphasize Product Integration for Differentiation

Sharp Leverages AI to Connect Devices; Panasonic Strengthens Energy Management Solutions

As of 2025, major Japanese electrical manufacturers have withdrawn from the sale of solar panels in certain overseas markets, driven by a challenging business environment and persistently declining panel prices. Sharp has exited the European market, while Panasonic Holdings (HD) has pulled out of the United States. Despite these setbacks, the global push for decarbonization and growing interest in self-consumption of renewable energy signal a positive mid-to-long-term market outlook. In response, companies are evolving their business models by integrating solar panels with complementary technologies and developing high-value-added products.

| Advertisement | |

At the end of March, Sharp discontinued its panel sales and large-scale solar project development in Europe due to deteriorating profitability, largely driven by price declines. The company also closed its subsidiary, Sharp Energy Solutions Europe. In April, Panasonic Electric Works (PEW)—a business unit under Panasonic HD—exited the U.S. residential solar panel and storage battery market. In its primary U.S. market, California, reductions in residential solar feed-in tariffs led to a significant drop in demand.

Both Sharp and PEW will continue to offer after-sales support in the regions they are exiting and will intensify operations in other promising markets. In Japan, Sharp is differentiating itself by developing AI-powered home energy management systems that integrate solar panels, storage batteries, and home appliances. Internationally, the company is focusing on emerging markets such as Vietnam and Thailand, where demand for self-consumption solutions is growing. Sharp aims to capture this demand by enhancing its price competitiveness.

PEW is expanding its energy management business by integrating its core electrical components with solar panels, Vehicle-to-Home (V2H) systems, fuel cells, and storage batteries. This comprehensive approach helps reduce electricity costs and promotes renewable energy self-consumption. While it has exited the U.S. market, where its business focused on power sales, PEW sees energy management as a promising new model.

Panasonic Holdings plans to leverage this technology to develop a business model in which 100% of electricity used at corporate offices is sourced from renewables. Demonstration projects are currently underway in Shiga Prefecture (Japan), the UK, and Germany.

Both Sharp and Panasonic are also accelerating the development of next-generation solar panels with higher added value. Sharp is investing in facilities to develop perovskite and space-grade solar cells as part of its three-year midterm management plan through fiscal year 2027. Panasonic has also launched a pilot production line for practical-sized perovskite solar cells at its facility in Moriguchi, Osaka Prefecture.

China’s Overproduction Drives Down Global Panel Prices

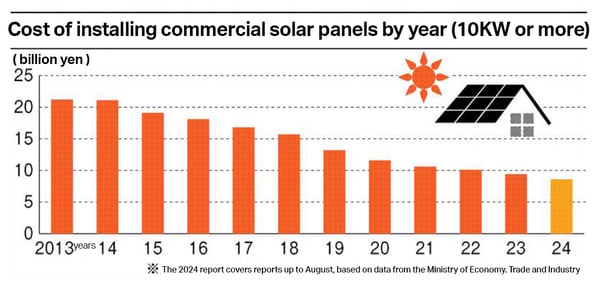

“The cheapest it's ever been”—that’s how one industry executive described current solar panel prices. Since late 2024, panel prices have plummeted, mainly due to overproduction in China, the world’s largest solar panel manufacturer. Following the Ukraine crisis, Chinese producers ramped up output, resulting in oversupply and aggressive price cuts. Sharp and Panasonic Holdings have already ceased panel manufacturing, with limited exceptions.

According to the Japan Photovoltaic Energy Association, 95% of solar panels distributed in Japan are imported, the majority from China. While lower prices benefit Japan by reducing installation costs, reliance on Chinese imports poses economic security risks. Should the supply of Chinese panels be disrupted, Japan’s ability to meet its greenhouse gas reduction goals would be jeopardized. Solar power remains a core strategy in Japan’s energy transition. Overdependence on a single country could also hinder Japan’s energy self-sufficiency.

Nine of the world's top ten solar panel manufacturers by shipment volume are Chinese, making a complete market withdrawal unlikely. However, diversifying procurement sources remains a pressing issue to safeguard Japan’s energy and economic security.

#Sharp #Panasonic #Perovskite #SolarCell #SmartEnergy #MReportTH #IndustryNews

Source: Nikkan Kogyo Shimbun

อ่านข่าวยอดนิยม คลิกที่นี่

อัปเดตข่าวทุกวันที่นี่ www.mreport.co.th

Line / Facebook / X / YouTube @MreportTH