Global Steel Industry Faces New Pressures: From China’s Overproduction to Rising Trade Barriers

Steel manufacturers are facing serious distortions in international supply and demand. The “reverse rotation” of globalization—such as the surge in steel exports from China, where demand has already peaked, and the growing risk of economic fragmentation driven by protectionist policies in major countries—is casting a shadow over business performance. At the same time, responding to steelmakers’ concerns, the Japanese government has recently launched investigations into measures to counter the influx of cheap Chinese steel, while major producers are pushing strategies to promote local production and consumption in the United States and India. Urgent action is needed to adapt to the changing market environment and restructure supply chains.

| Advertisement | |

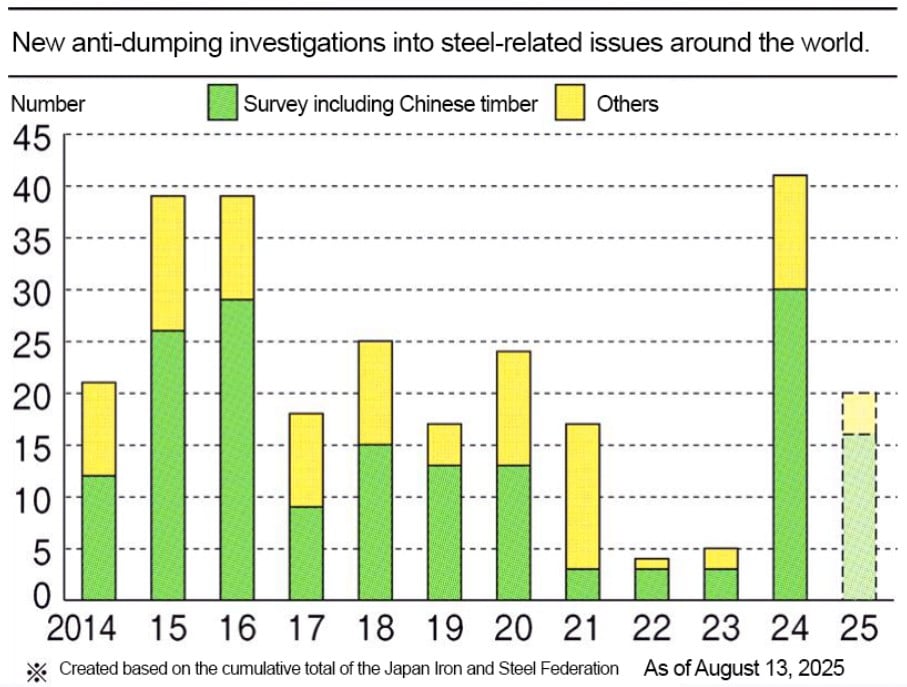

Last year’s anti-dumping cases hit record high of 30

“We need to be prepared to withstand (China’s overproduction) even if it becomes the norm,” said Takahiro Mori, vice chairman of Nippon Steel Corporation, expressing concern over worsening market conditions caused by a surge in Chinese steel exports.

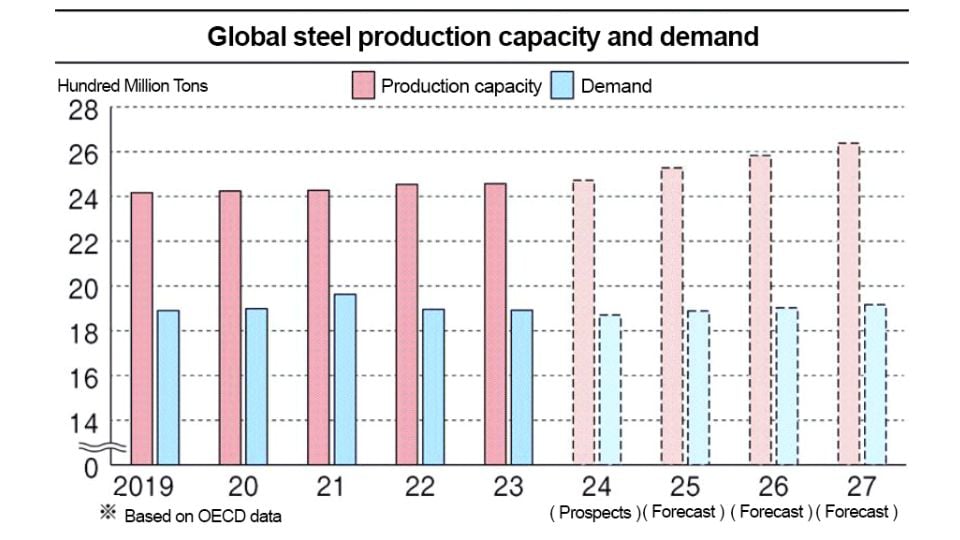

According to the Organization for Economic Cooperation and Development (OECD), global surplus production capacity relative to steel demand is expected to expand to a maximum of approximately 700 million tons by 2027, a 30% increase from 2023. The OECD report warned that subsidies by China and other countries are “exacerbating global imbalances” by encouraging unprofitable investment, fueling export surges, and prompting trade sanctions worldwide.

In fact, countries are increasingly moving to curb Chinese steel. According to statistics compiled by the Japan Iron and Steel Federation, there were 41 new anti-dumping (AD) investigations related to steel globally in 2024, of which 30 involved Chinese materials—both record highs. Under World Trade Organization (WTO) rules, if products are exported at unfairly low prices compared to domestic market levels, causing harm to local industries, tariffs may be imposed equivalent to the price difference.

Japan launches first AD investigations into primary steel products

In July, based on applications from Nippon Steel and Nippon Yakin Kogyo, the Japanese government launched an AD investigation into stainless steel products from China and Taiwan. This marked the first time Japan had initiated an AD investigation into primary steel products. In August, the government followed with another probe into hot-dip galvanized steel products from China and South Korea. A Nippon Steel official commented, “Steel imports are rising, partly due to the knock-on effects of Chinese overproduction.”

However, in the current climate of distorted international supply and demand, there is growing risk that increased trade measures could affect Japanese exports. In April, India provisionally imposed safeguard tariffs on certain steel products, which in principle apply to all countries. In July, South

Korea provisionally decided to impose anti-dumping duties on imports of hot-rolled steel sheets from China and Japan. JFE Holdings (HD) Executive Vice President Masashi Terahara criticized the decision, saying, “It is inappropriate and regrettable that Japanese products have been recognized as damaging to the Korean industry,” and pledged to work with the Japanese government to respond.

Local production and consumption in the US and India

As Japan’s domestic demand continues to shrink, major steelmakers are actively targeting growing overseas markets. Amid rising protectionism in the United States and elsewhere, they are pursuing strategies that combine partnerships with local firms and technology transfers to secure demand for high-quality steel.

Nippon Steel is moving quickly to restructure U.S. Steel, the American steelmaker it acquired in June. The company is racing to establish a system capable of generating profits of around 250 billion yen by fiscal 2028. Including a new production line scheduled to start in 2025, it already has the foundation to earn approximately 150 billion yen, and plans to expand further with high-quality electromagnetic steel sheets for electric motors. Capital investments of about $11 billion (roughly 1.6 trillion yen) are also expected to deliver full returns starting in fiscal 2029. “We will aim for even higher profits,” Vice Chairman Mori emphasized.

Meanwhile, JFE Steel will invest an additional 120 billion yen in India’s electrical steel sheet business for power infrastructure in partnership with JSW Steel, a major local producer and equity-method affiliate. JFE will increase annual capacity to about 350,000 tons by 2030—3.5 times its previous plan—expanding sales of high-value-added electrical steel sheets with low energy loss for use in transformers supplied to government-affiliated utilities and other entities.

JFE Steel Executive Vice President Hiroyuki Ogawa noted, “Japanese automakers, who have long been our key customers under the vertical division of labor, are now facing fierce competition from Chinese companies. As localization accelerates in response to geopolitical risks, our core strategy will be to become true insiders by partnering with local companies such as JSW.”

Turning point for the steel market

The slowdown of the Chinese economy, once called the “world’s workshop,” combined with the rise of protectionism and shrinking domestic demand in Japan, has brought the steel market’s supply and demand structure to a major turning point.

The key question now is: Can Japanese steelmakers quickly build local production systems capable of supplying high-quality steel to promising overseas markets, while working with the government to shield themselves from unfair trade practices?

The answer will determine their path to future growth.

Source: Nikkan Kogyo Shimbun