US Steel Acquisition Approved: Nippon Steel Moves Forward with ¥4 Trillion Investment Offensive

Trump Reverses Stance, Endorses Nippon Steel’s Acquisition of US Steel

US President Donald Trump has expressed his intention to approve Nippon Steel’s acquisition of US Steel, a major American steelmaker. In a complete reversal of his previous opposition to the acquisition, Trump emphasized that his tariff policy has attracted massive investments from Nippon Steel. However, he has not revealed details such as the percentage of shares to be acquired. A year and a half after the acquisition plan was first announced, the deal is reaching a climax, as Nippon Steel aims to make US Steel a wholly owned subsidiary to facilitate technology transfer.

- TCRSS and TCS Merge to Enhance Synergy, Market Expansion and Operational Efficiency

- Trump Ignites Tariff War: Auto, Steel, and Aluminum Under Fire

Advertisement

On the 23rd, Trump posted on social media: “This is a planned partnership between US Steel and Nippon Steel that will create at least 70,000 jobs and contribute $14 billion (approx. ¥2 trillion) to the U.S. economy.” He highlighted the effectiveness of his tariff policy, stating, “The tariffs will ensure that steel is once again Made in America forever.”

Nippon Steel released a statement saying it “wholeheartedly respects President Trump’s bold decision,” and emphasized that its proposal aligns with the Trump Administration’s commitment to protecting American workers, the American steel industry, and national security.

The U.S. Emerges as a Key Battleground Amid Global Supply Chain Disruptions Nippon Steel to Invest ¥4 Trillion in the U.S., Becoming the World’s No. 3 Steelmaker

Nippon Steel has consistently stated during negotiations with the U.S. government that its goal is to make US Steel a wholly owned subsidiary. According to President Tadashi Imai, the company proposed a growth investment of approximately ¥2 trillion, including construction of a new plant in the U.S., contingent on the acquisition. Combined with the ¥2.2 trillion allocated to acquire 100% of US Steel’s shares, the total investment is expected to reach about ¥4 trillion. This massive commitment appears to have convinced Trump to reverse his initial opposition and endorse the acquisition.

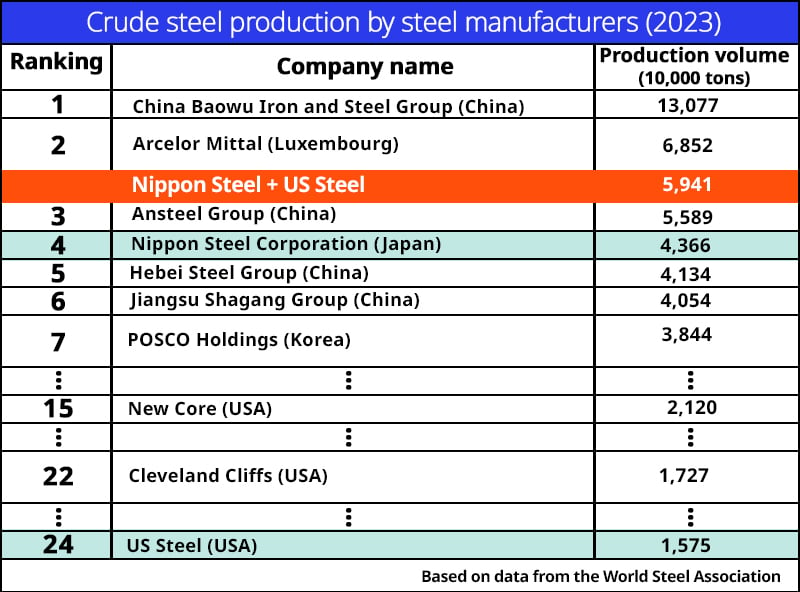

If successful, the acquisition will increase Nippon Steel’s crude steel production volume in 2023 by nearly 40%, to approximately 59 million tons, making it the third-largest producer globally. With China continuing to overproduce steel, the acquisition would enable Nippon Steel to launch an offensive into the vast U.S. market, where cheap Chinese steel is less competitive due to tariffs. “It’s becoming increasingly clear that integrated production within the U.S. is important,” Imai said, especially given supply chain disruptions exacerbated by new tariffs. With Trump now backing the acquisition, Nippon Steel’s global strategy is entering its final phase.

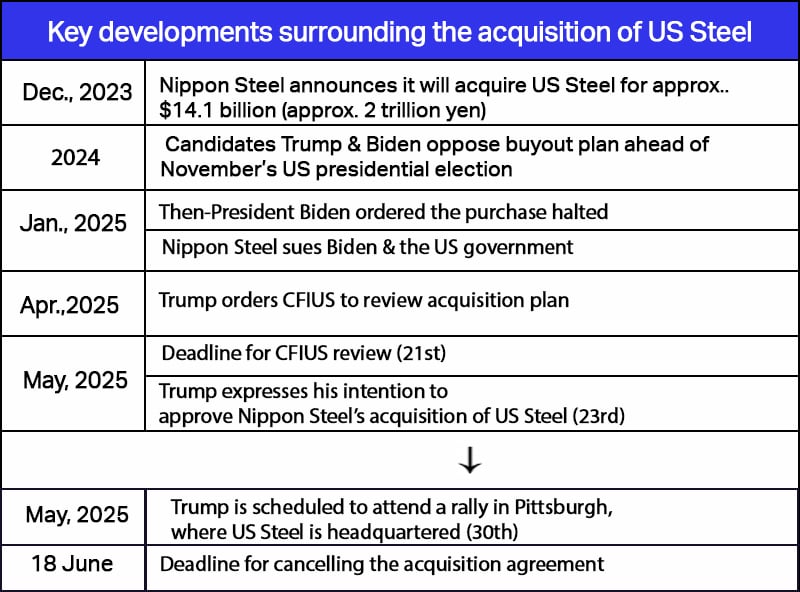

The deal has been in motion since Nippon Steel and US Steel signed an agreement in December 2023 to make US Steel a wholly owned subsidiary. The acquisition was initially expected to close by mid-2024, but was delayed due to opposition from the United Steelworkers (USW) union and political entanglements during the 2024 U.S. presidential election.

During that election, both Trump and then-President Joe Biden expressed opposition to the deal. In January 2025, President Biden formally blocked the acquisition on national security grounds. However, Nippon Steel continued its negotiations with the new Trump administration, proposing increased investments. In April, Trump instructed the Committee on Foreign Investment in the United States (CFIUS) to reexamine the deal. Based on CFIUS’s findings, Trump concluded that the national security concerns had been addressed

Meanwhile, US Steel’s financial performance deteriorated, with the company posting losses for two consecutive quarters beginning in Q4 2024. “That’s why we want to close the acquisition as soon as possible,” said Takahiro Mori, Vice Chairman of Nippon Steel, underscoring the urgency

The deadline to terminate the agreement under Biden’s earlier cease-and-desist order was extended from February 2 to June 18, with CFIUS approval. The key now is whether negotiations can be finalized by then—especially in light of the rapidly shifting economic and political landscape, including new tariffs.

A major unresolved issue is the percentage of shares Nippon Steel will acquire. Although Trump has signaled approval on social media, details of the acquisition structure remain unclear. Nippon Steel has maintained, “There is no such thing as free technology transfer or investment without a return,” according to Vice Chairman Mori, reaffirming its intent to pursue a full acquisition.

The U.S. Emerges as a Key Battleground Amid Global Supply Chain Disruptions

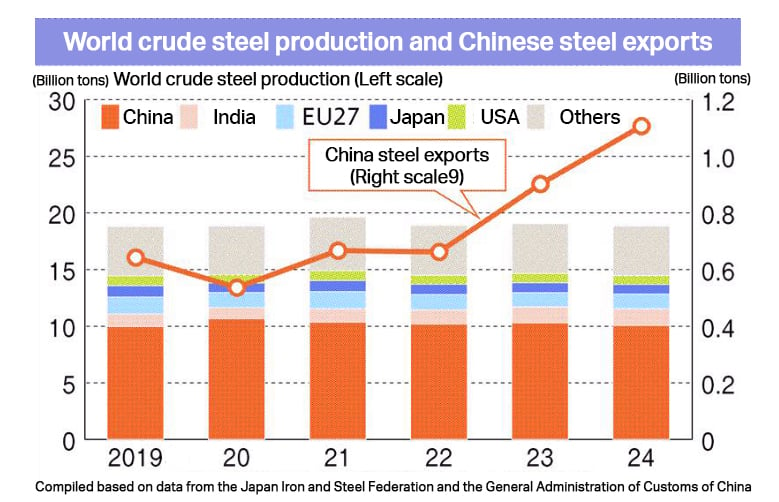

The push to acquire 100% of US Steel stems from changes in the global steel market. As domestic demand declines in Japan, China continues to export surplus steel, worsening global competition. In 2024 alone, China’s steel exports increased by about 20% year-on-year.

Nippon Steel views the U.S. as “the world’s largest market for high-grade steel” and aims to improve profitability through local production and the sale of high-value-added products, including high-strength steel for vehicles and electrical steel for EVs. Full ownership of US Steel is seen as essential for transferring and protecting this unique production technology.

In his social media post on the 23rd, Trump also said, “After much consideration and negotiation, I am proud to announce that US Steel will remain in the United States and its headquarters will remain in the great city of Pittsburgh,” implying ongoing U.S. involvement in the company’s management. Given Trump’s unpredictable tariff policies, however, the outcome of the acquisition remains uncertain until the final agreement is signed.

Final negotiations will require Nippon Steel to continue pressing its case that a wholly owned subsidiary and full technology transfer will support the revitalization of U.S. manufacturing.

#NipponSteel #USSteel #Trump #MandA #MadeInUSA #MReportTH #IndustryNews

Source: Nikkan Kogyo Shimbun